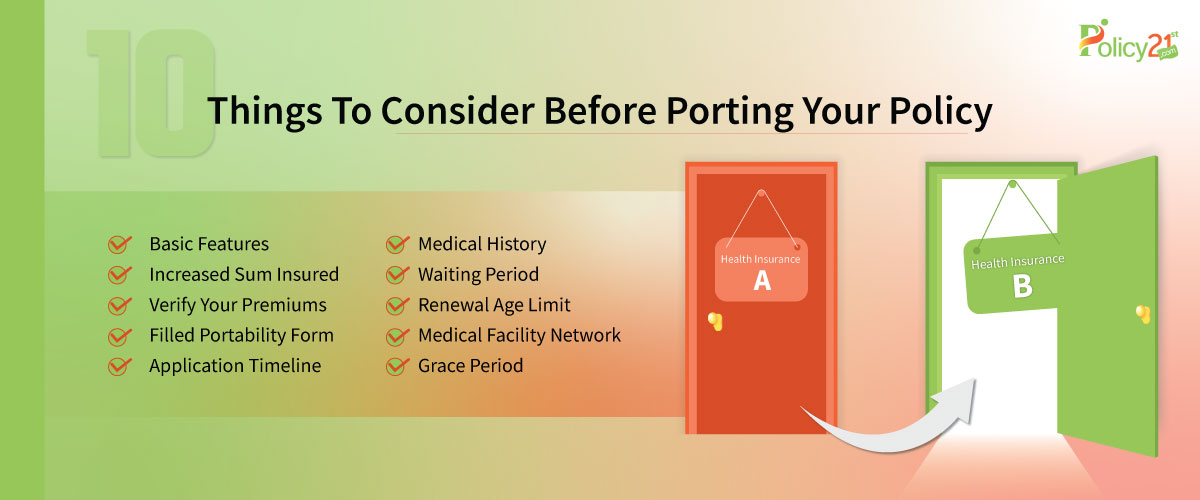

Every policyholder has the right to port their health insurance policy from one insurance company to another, as stated by the IRDAI. You would not have to start over when you port your health insurance policy because you can also transfer your earned bonus and waiting periods.

There might be a variety of reasons for your health insurance portability like as finding a better individual health insurance or family health insurance plan elsewhere or simply not being satisfied with your current insurer. However, what should you take into account before porting your health insurance policy?

1- Basic Features

Select a health insurance plan that covers both hospitalization and childcare services, with no upper limit. Keep in mind that each policy is unique and subject to underwriting regulations.

2- Increased Sum Insured

You can always request an increase in the guaranteed amount when applying for health insurance portability, business insurance portability, or travel insurance portability. However, the insurance provider has complete control over this.

Additionally, you can come directly under the new service provider’s scrutiny if you try to port out a single member of a floater cover with a significant rise in the amount guaranteed. This usually happens when you want to exclude an undesirable medical condition to get better coverage.

3- Verify Your Premiums

Most of the policyholders choose to port health insurance policies when they find one with a lower premium. However, finding approaches to minimize costs is usually a good idea, but there are situations when choosing the lowest premium is not the smart approach.

During your health insurance portability, make sure the new insurance provides you with every benefit, feature, and coverage you need for medical requirements. If not, you may find yourself having to pay an extra amount out of your pocket in case of an emergency.

4- Filled Portability Form

There are two main reasons that might lead to the rejection of your health insurance portability application form-

- Providing false or inaccurate information on your health insurance portability application form.

- Not having access to existing policy papers.

5- Application Timeline

As per IRDAI guidelines, a porting request must be submitted at least 45 days before the existing policy’s renewal date. If there is a delay, the new insurer may refuse to accept your application. Therefore, it is essential that you start the process well in advance like 90 days before, to be safe.

Have Any Question?

Ask us anything, We would love to answer!

6- Medical History

You cannot go for the health insurance portability if you have a pre-existing illness or a health issue that requires regular hospital visits. If the applicant is above 45 years old, a medical examination is required to examine the health of the applicant.

Besides, your application for health insurance portability may be rejected by the new insurer if your medical conditions indicate the presence of diseases like diabetes or high blood pressure. In addition to this, your application can also be rejected if you have a history of heart attacks or renal failure, or illnesses with large continuous expenses.

7- Waiting Period

Health insurance policy comes with the 3 types of waiting period. The first waiting period is 30 days for new policies. The second is for illnesses like kidney stones and appendicitis that are covered after a year or two. The third waiting period is four years for pre-existing illnesses like type 2 diabetes, cancer, and heart disease.

If you wish to port your three-year-old health insurance policy (after completing 2 years) to a new insurer with the same waiting periods, then the waiting periods of 30 days and 2 years will not apply. Only 4-year waiting time will be active. You will need to wait 1 year more to make claims for pre-existing conditions as you have three years left on your earlier health insurance policy.

8- Renewal Age Limit

Most health insurance providers are unwilling to approve requests for health insurance portability for senior citizens, as an individual’s sensitivity to health issues increases with age. If an insurer notices that an applicant is older than 55, they may additionally impose higher loading charges.

8- Medical Facility Network

form, your new health insurance provider will notify you whether it was approved or not.Make sure the new health insurance policy you select offers a trustworthy network of physicians and hospitals in areas that are convenient for you. When an emergency arises, you must get to the closest hospitals that offer superior medical treatment. Your new health insurance policy must cover hospitals that provide overall medical facilities. This is something you should keep in mind while going for a health insurance portability.

9- Check The Policy Type

You should know that you can only port your existing health insurance policy to another health insurance policy of a similar type. During the portability, the coverage, plan, or type of policy cannot be completely changed. For instance, porting from individual health insurance to family health insurance is not possible.

Still, to avoid any unexpected expenses, it is important that you thoroughly understand the coverages and exclusions of the new policy. Therefore, make sure to verify the co-payments, room limitations, deductions, and sub-limits of the new plan.

10- Grace Period

Within 15 days of submitting the portability application

You are allowed a 30-day grace period while the process of your health insurance portability is proceeding. If the new insurer does not notify you in a timely manner, you still have time to renew your current insurance during this time. This makes sure that you get continuous coverage.

Final Thoughts -

A health insurance policy is an important financial backup in case of an unexpected medical emergency. It allows you to receive the best medical care without worrying too much about the expense. As a result, you can save your hard-earned funds.

However, it might be time for a change if you are dissatisfied with your existing health insurance policy. Even though health insurance portability is relatively simple and carries over your benefits, keep the above things in mind before doing so to make sure you have the most comprehensive coverage of your individual health insurance or family health insurance.

Policy21st offers wide options to explore and analyze the features of different health insurance companies and then choose the best one that satisfies your overall requirements and gives you the maximum benefits.