Why is health insurance important?

Life is very unnatural; however, death and taxes are natural. Since COVID, we have started to take our health very seriously. More importantly, we also have to understand how important it is to access high-quality healthcare effortlessly.

Health insurance is a necessity for any medical emergency, as it provides the necessary financial support in times of need. However, surgery and hospital stays can burn a large hole in your wallet and deplete your hard-earned funds. You can prevent all of these if you are already prepared and get health insurance. All it needs is a yearly fee, and that too is well worth it.

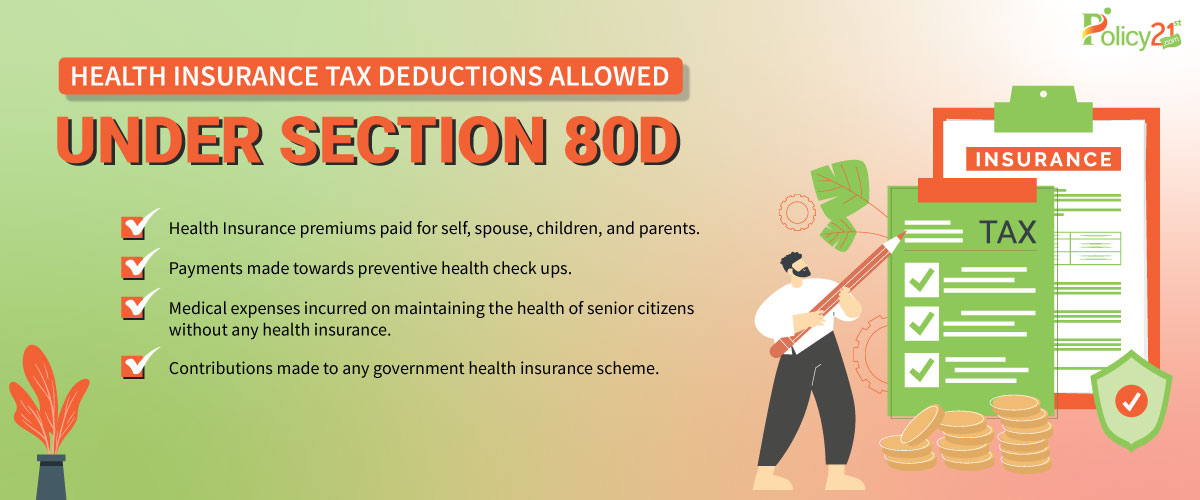

Insurance companies and the government provide multiple benefits to encourage and promote the idea of purchasing health insurance coverage. The government offers an income tax benefit under Section 80D to promote the purchase of health insurance. Let us read below all about tax benefits and deductions.

What are the tax benefits of health insurance?

Beyond the medical coverage and treatment compensations, you also get tax exemptions for the health insurance premiums you pay for your policy. This eases your ability to access healthcare facilities.

The Indian government has put in place several initiatives for easy access to high-quality healthcare. Section 80D of the Income Tax Act is one of these examples. It involves deducting a payment that must be made to receive medical insurance. Every individual or Hindu Undivided Family (HUF) member is eligible for tax deductions. These deductions are from their total yearly income for the premiums paid for health insurance policies purchased for themselves and their dependents, like their spouse, kids, and aging parents. All top-up health insurance and critical illness policies are also eligible for this deduction. The best part is that you receive more benefits than those provided by Section 80C.

Tax Benefits of Health Insurance Under Section 80D

- Purchasing health insurance coverage allows you to have several tax benefits under Section 80D.

- You are allowed up to ₹ 25,000 in deductions on the premium paid in each financial year. This type of medical insurance deduction is available to you, your spouse, and your kids.

- Tax benefits are also available for yearly preventative health checkups. According to Section 80D of the Income Tax Act, the claim is limited to ₹ 5,000.

- According to Section 80D of the Income Tax Act, you can get tax benefits on paid premiums only if your parents are dependent on you.

- As per the Income Tax Law, you can claim a tax exemption under Section 80D for up to ₹ 5,000 towards the costs expended for your parents' preventative check ups if they are under 60 years of age. Additionally, it also allows you to receive a tax deduction under Section 80D for up to ₹50,000 in health insurance premiums.

- Based on the premium you pay for your parent's health insurance while they are 60 years of age or older, you can receive tax benefits of up to ₹ 80,000 (which includes preventative yearly health examinations) when you are 60 years of age or younger.

- If you are 60 years of age or older and pay the premiums for your parents' health insurance coverage (who are also senior citizens), you are eligible for a tax deduction under Section 80D up to ₹1,07,000 (which covers yearly preventative health exams).

Have Any Question?

Ask us anything, We would love to answer!

Exclusions of Health Insurance Tax Benefits -

- Only trackable payments are eligible for all tax deductions. If you pay your premium in cash, you will not receive any tax benefits.

- There is a 15% service tax on health insurance premiums. On such a sum, there is no financial relaxation. The service tax and any applicable tax costs must be paid along with the insurance premiums.

- Under Section 80D, group health insurance premiums provided by the company will not be eligible for tax deductions. However, by paying an extra premium, you can take advantage of premium deductions for group health insurance for better coverage.

- You cannot receive tax benefits from the medical coverage for your grandparents, siblings, or any other family members.

Documents Required To Claim Health Insurance Tax Benefits Under Section 80D

As of right now, no documented proof is needed to claim health insurance tax benefits under Section 80D. Except for using cash, you must make premium payments in trackable mode. Tax deductions of up to ₹ 25,000 are available to every person or HUF member who purchases health insurance for themselves and their immediate family. The Income Tax Act generated an extra deduction slab of ₹ 50,000 if the primary policyholder’s parents are elderly citizens, up to a maximum of ₹ 40,000 if the parents are under 60, and up to INR 1 lakh if the parents are 60 years of age or older.

Have Any Question?

Ask us anything, We would love to answer!

Final Thoughts -

Having health insurance is an essential step in protecting your finances from unexpected expenses. Waiting to get health insurance in an emergency might lead to a serious financial crisis. Now is the right time to make health insurance investments. It provides several tax benefits along with serving as a safety net for you and your loved ones. For more people, health insurance becomes a viable choice due to these exemptions and reimbursements. You are qualified for several tax deductions under Section 80D of the Income Tax Act when you purchase health insurance for yourself and/or your parents.

Policy21st offers a wide range of health insurance policies from reputable insurance companies. We have insurance policies available for every individual, be it for your parents, your children, or yourself. You can also compare different insurance plans and then choose the plan that best covers all your financial and future needs. The earlier you buy, the more beneficial your plan will be. Visit our website today and protect your loved ones.