Star Health Insurance offers different insurance plans for different individual needs. Their top-up plans are the Star Comprehensive Plan, Family Health Optima Plan, and Young Star Insurance Plan. All these plans have different features, inclusions, benefits, sum insured, co-pay, etc. So how will you know which plan is best for you and your family’s specific needs? In this blog, we have explained the plan essentials, inclusions, and reasons why you should buy from Star Health Insurance. Let us read in detail.

How does the Star Comprehensive Plan differ from the Family Health Optima Plan?

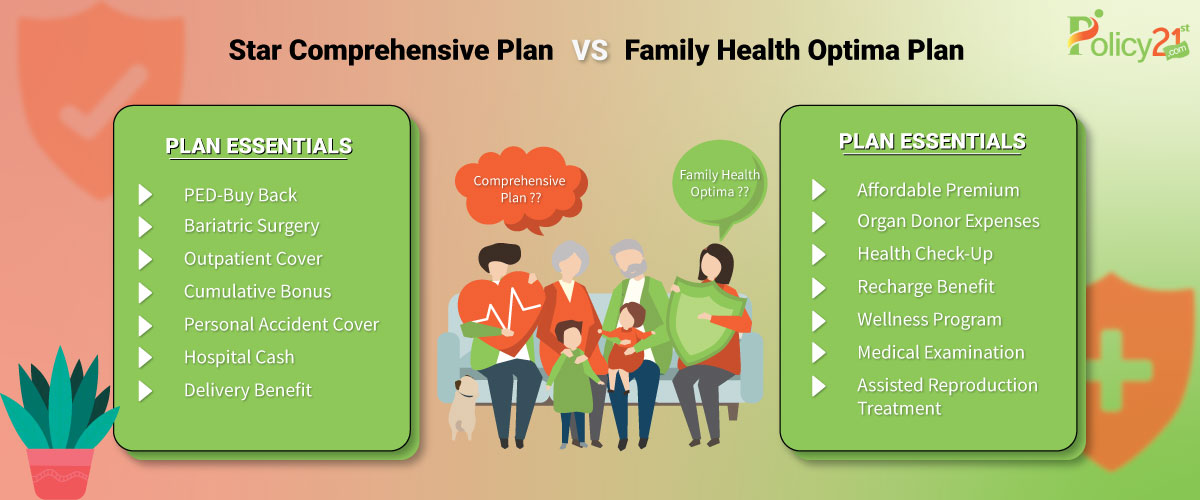

In Terms Of Plan essentials :

Star Comprehensive Insurance Plan-

- This plan provides you with an optional cover under which the waiting time for pre-existing diseases can be shortened from 3 years to 1 year when you buy an extra premium.

- Hospitalization costs for bariatric surgical procedures are reimbursed up to the limitations specified in the insurance clause.

- Pre- and post-natal expenses associated with both normal and C-section deliveries are covered up to the specified limits of the insurance clause.

- The cumulative bonus is computed at 50% of the basic sum insured up to a maximum of 100% for the sum insured of Rs. 5 lakhs after every claim-free year. However, for the sum insured above Rs. 7,50,000, the cumulative bonus is computed at 100% of the basic sum insured.

- 100% of the sum insured is restored once in the policy year after depletion of the basic sum insured, which may be used for illness or disease for which claims were already made during the policy period.

- During the policy period, worldwide personal accident coverage is provided at no additional premium in case of accidental death or permanent, complete disablement of the insured person.

- Up to a maximum of 7 days per hospitalization and 120 days during the policy term, a cash benefit is given for each completed day in the hospital, up to the limitations stated in the policy clause.

Have Any Question?

Ask us anything, We would love to answer!

Family Health Optima Insurance Plan -

- The Family Health Optima Plan provides coverage for family members such as the policyholder, spouse, up to three dependent children, parents, and parents-in-law at a reasonable premium.

- Every claim-free year, network hospitals of the insurance company will pay for medical check-up expenses up to the specified limitations.

- If the insured individual is the recipient, organ donor expenses are covered as long as the transplantation claim is paid.

- 100% of the sum insured will be restored 3 times in the same policy year upon exhausting the coverage limit during the policy period.

- When the coverage limit is reached, an extra indemnity is offered, which can be used for the same hospital stay or to treat the illness for which the claim was approved or paid for under the policy terms.

- Expenses used for proven assisted reproductive treatments listed in the policy clause are reimbursed up to the specified limit.

- Hospitalization coverage for a newborn baby starts on the 16th day after delivery and is limited to 10% of the sum insured, or INR 50,000. It is, however, reduced as long as the mother maintains continuous coverage for 12 months under the policy without disruption.

- Pre-acceptance medical screening is mandatory for all individuals over 50 and those with a previous medical history, and it must be done at the centres approved by the insurance company. Currently, the insurance company covers all medical screening expenses.

- Policy terms of 1-2 years are available for the policy.

- The Family Health Optima Plan offers wellness reward programs.

In Terms Of inclusions -

Star Comprehensive Insurance Plan-

- You can purchase this plan as a floater or individual.

- This plan is available to any individual aged between 18 and 65. Dependent children are protected from the 91st day up to 25 years.

- The plan includes ambulance fees for hospital admission, transfers between hospitals for better facilities, and from the hospital to the patient’s home.

- Air ambulance coverage up to Rs. 2,50,000 for each hospitalization, or a maximum of Rs. 5,00,000 per coverage year.

- The insurance can include the recently married spouse and their newborn child by paying an extra premium. Their waiting period will start on the day of inclusion.

- Insured individuals aged 61 or above are required to pay 10% of the claim amount for both new and renewed plans at the time of entrance.

- 100% of the sum insured will be restored once in the policy year if the coverage limit is reached within the policy period.

- A cash benefit of up to a maximum of 7 days per hospitalization and 120 days during the policy term is provided for each completed day up to the specified limit in the policy clause.

- Pre- and post-natal delivery expenses, including the Caesarean section (maximum of 2 deliveries), are reimbursed up to the specified limit in the policy clause.

- Hospitalization expenses for a newborn are covered based on the sum insured you choose, up to the specified limit in the policy clause.

- Hospitalization expenses coverage up to Rs. 2,50,000 and Rs. 5,00,000 (including pre-and post-hospitalization expenses) related to bariatric surgery procedures.

- The Star Wellness Program includes many wellness activities to inspire and support the insured person in leading a healthy lifestyle. The wellness bonus points gained can be used further for renewal discounts.

- Outpatient expenses for treatments other than dental and ophthalmic treatments received in the networked facility are covered up to the specified limit in the policy clause.

- Outpatient cost coverage for dental and ophthalmic treatments is available to the covered individual following each three-year block, up to the specified limit in the policy clause.

- Every claim-free year, network hospitals will pay for medical check-up costs up to the specified limit in the policy clause.

Have Any Question?

Ask us anything, We would love to answer!

Family Health Optima Insurance Plan -

- You can purchase this plan as a floater only.

- This plan is available to any individual aged between 18 and 65. Dependent children are protected from the 16th day up to 25 years.

- A wide coverage is provided to the family members, including the policyholder, spouse, parents, in-laws, and dependent children (maximum up to 3).

- The expenses of the insured person living in shared accommodation are covered up to the specified limit in the policy clause.

- Road ambulances cover up to Rs. 750 per hospitalization and Rs. 1500 per insurance period for insured individuals carried by a private ambulance.

- Air ambulance costs are reimbursed up to 10% of the total sum insured throughout the policy.

- The sum insured will be raised by 25% up to a maximum of Rs. 5,00,000 in case the policyholder has a traffic accident that requires in-patient hospitalization.

- You can get a discount of 5% for completing the survey on lifestyle and habits at policy inception.

- Insured individuals aged 61 or older are required to pay 20% of the claim amount for both new and renewed plans at the time of entrance.

- Cost coverage for the cataract treatment up to the specified limit of the policy clause.

- Organ transplant-related expenses are reimbursed up to 10% of the total sum insured for a maximum of Rs. 1,00,000, whichever is less.

- Expenses coverage up to Rs. 5,000 per policy period for the dead remains repatriation of the insured person.

- Recharge benefits are available within reasonable limits.

- 100% of the sum insured will be restored 3 times in the policy year if the coverage limit is reached within the policy period.

- A lump-sum payment equal to 1% of the insured amount up to Rs. 5,000 will be made within the policy year if the treatment is received in a hospital recommended by the company.

Have Any Question?

Ask us anything, We would love to answer!

Why Buy These Insurance Plans From Star Health Insurance?

Star Benefits -

- You can participate in the wellness programs and earn rewards for maintaining your health. Redeem those points later to get renewal discounts.

- Talk to the knowledgeable physicians at the Star for a free phone, chat, or video consultation.

- You can also see one of the medical professionals at the Star for a free COVID-19 consultation between 8 a.m. and 10 p.m.

- You can get access to 1,635 diagnostic centres in India and get test samples and health checkups delivered right to your door.

- Store pick-ups and home deliveries are offered across 2780 cities, allowing you to buy medications online at a reduced cost.

Claims -

- 24/7 customer support is available for claim notification, telehealth services, and answering your queries.

- Star Health Insurance is the first independent health insurance provider that uses its in-house team to handle claims without any TPA.

- 92% of their claims are resolved under reimbursement within 7 days, and 90% are settled under cashless within 2 hours.

- Their plans offer coverage by reputed service providers, agreed networks, and network hospitals for high-quality treatment.

- Star Health Insurance has been awarded by reputable survey organizations for innovative products, high claim settlements, and service providers.

Hospitals -

- The network hospitals of Star Health offer easy cashless services. They have easy-to-use and fast procedures.

- The network hospitals of Star Health have agreed to affordable package prices for medical and surgical services.

- Selected hospitals operated by Star Health have received special recognition for their work, offerings, and quality.

- You can also file reimbursement claims at non-network hospitals.

- Hospitals that are not allowed to accept claims are excluded providers. However, charges related to accidents or life-threatening conditions must be paid for until normalization.

Have Any Question?

Ask us anything, We would love to answer!

Final Thoughts -

Now that you have understood all about the Star Health Comprehensive Plan and Family Health Optima Plan and how they are different from each other. If you are looking for a reliable platform to buy the best plan for your needs, Policy21st is the right option for you. At Policy21st, all you need to do is provide your basic details, and then you can go through a wide range of insurance plans. You can compare these plans and choose the plan that fulfils all your coverage needs. When you are sure of all your inquiries and ready to buy, you need to pay and get your policy within a few minutes. Also, for further help, feel free to contact us. Our team of experts is ready to answer your queries 24/7.