What is Insurance Misselling?

Insurance misselling is the practice of selling an insurance policy to a customer in a way that is unsuitable for their requirements or that is improper or false, causing financial harm. It happens when an individual is given insurance coverage on misleading claims, with inaccurate information, or without an in-depth analysis of their needs and situation. This results in customers purchasing inappropriate insurance plans.

The few instances of insurance misselling include false information about policy terms or benefits, forcing clients into purchasing policies they do not need, or hiding crucial information regarding the policy’s coverage or restrictions. Individuals who purchase insurance miserably can suffer severe financial and legal consequences, which could damage public confidence in the insurance sector. Insurance misselling can show up in several ways:

- Misinterpretation: Agents that give inaccurate or deceptive information on the conditions, benefits, or limitations of an insurance policy are engaging in misrepresentation.

- Overemphasis on Commission-driven Products: Placing greater focus on selling policies that will increase the agent’s fee than on those that fit the customer’s needs.

- Failure to Disclose Vital Information: Deceiving the customer by hiding important information regarding policy exclusions, restrictions, or potential risks.

- Pressure Selling: Using forceful or aggressive methods to convince clients to buy insurance products they do not need or understand.

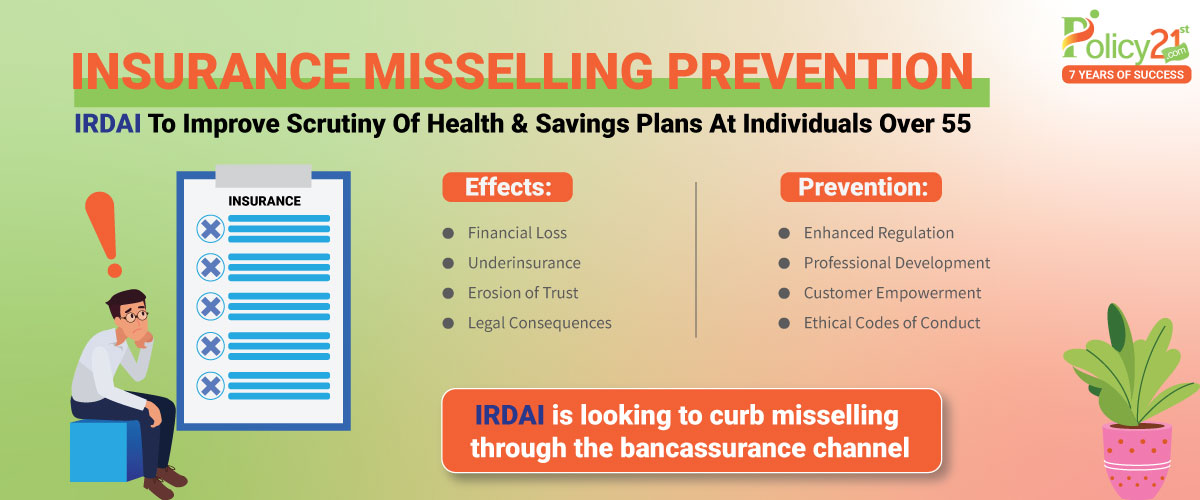

Effects of Insurance Misselling

Insurance misselling can have serious and wide-ranging effects:

- Financial Loss: Investing in policies that do not live up to promises can make customers suffer financial losses and instability.

- Underinsurance: As a result of missold plans, inadequate coverage can expose people and companies to unexpected risks including medical crises, property damage, or tort claims.

- Erosion of Trust: The insurance sector suffers from misselling, which damages the reputations of both brokers and insurers. Lack of trust can discourage people from getting essential insurance coverage in the future.

- Legal and Regulatory Consequences: Insurance misselling is against customer protection laws and regulations, which subjects insurers and agents to penalties, legal action, and harm to their reputations.

Have Any Question?

Ask us anything, We would love to answer!

What are the preventive measures to combat Insurance Misselling?

Several preventive actions can be taken to fight insurance misselling and preserve ethical principles in the industry:

- Enhanced Regulation: This refers to strengthening legal frameworks to ensure accountability, equity, and transparency in insurance sales practices.

- Professional Development: This refers to giving insurance agents extensive training and continuing education so that they have a solid grasp of the products, moral principles, and customer-focused marketing techniques.

- Customer Empowerment: Providing customers with the information and tools they need to make well-informed decisions about buying insurance, like comparison tools and transparent policy terms disclosures.

- Ethical Codes of Conduct: Establishing and upholding rules of conduct among insurance professionals to promote honesty, integrity, and customer welfare.

Have Any Question?

Ask us anything, We would love to answer!

IRDAI Plans to improve Scrutiny of Products aimed At 55+ -

To stop the misrepresentation of expensive insurance products to those over 55, the insurance regulator is trying to increase transparency and strengthen monitoring. Mandatory video verification, audits, evaluation standards, and policy document templates are some of the measures. Vivek Joshi, the secretary of financial services, met with the heads of state-run banks in December 2023 to discuss matters of BANCASSURANCE, such as how to boost insurance penetration and challenges such as misselling.

According to individuals with an understanding of the situation, the Insurance Regulatory and Development Authority of India, or IRDAI, is in talks with banks and other players about mandating video verification before policy approval and ensuring transparency in sales.

“There is a view that scrutiny for complex products needs to be tightened further. This should be more so in cases where the benefits fluctuate on account of market-linked products and health or savings products offered to the age group above 55,” the person said, adding that a case is also made for greater transparency while selling such products, especially to illiterate customers.

The regulator is also in discussion for more accountability from all parties. This includes developing a suitable framework for auditing customer results, solicitation process, and redressal methods.

“IRDAI is looking to curb misselling through the bancassurance channel, and it has been suggested that bancassurance partners will not assign any targets and give direct or indirect incentives to their staff for selling policies,” said a bank executive, adding that the proposal also entails audits at regular intervals.

Do You Know?

Bancassurance refers to the partnership between insurance firms and banks to sell insurance products via bank branches.

The person above mentioned stated that along with other things, IRDAI has recommended that bancassurance partners make use of templates and evaluation criteria developed by insurers as part of the policy documents.

In 2022-2023, banks served as corporate agents and contributed 5.93% of non-life premiums and 17.44% of new business life insurance premiums.

According to a story published by ET last week, the Income-Tax Department has issued an evaluation report on how some intermediaries were used by insurers to pay their agents an additional commission above the allowed regulations who sold insurance products.

Have Any Question?

Ask us anything, We would love to answer!

Final Thoughts -

Insurance misselling compromises the core values of honesty and trust that govern the insurance business. Stakeholders can cooperate by promoting accountability, transparency, and customer empowerment to reduce the risks of misselling and protect policyholder interests. By working together and maintaining a strong commitment to moral principles, we can foster an honest and trustworthy culture in the insurance industry, ensuring that everyone has the security and comfort they truly deserve.