The insurance regulator, IRDAI has removed the age restriction of 65 for those purchasing health insurance plans to expand the market and promote sufficient protection against medical costs. This is a major shift from the traditional limitations that restricted people from getting full coverage.

The Insurance Regulatory and Development Authority of India (IRDAI) wants to develop a more accessible and inclusive healthcare environment by eliminating the maximum age limit on buying health insurance policies. This will ensure enough coverage against unexpected medical expenses.

What are the updated Health Insurance IRDAI Guidelines in 2024?

The existing laws related to health insurance products have been updated by the Insurance Regulatory and Development Authority of India (IRDAI). Let us read further and know the changes made on new health insurance policies that became applicable on April 1, 2024:

Have Any Question?

Ask us anything, We would love to answer!

1. No Minimum Age to Purchase Health Insurance

- IRDAI has eliminated the upper age limit for purchasing a health insurance policy in India.

- Earlier, the upper age limit to purchase health coverage used to be 65.

- However, the new regulations have removed this age cap so that any individual can get health insurance, regardless of age.

- This update is highly beneficial for senior citizens as they can now purchase a comprehensive Mediclaim policy at any time.

2. Waiting Period for Pre-existing Diseases (PEDs) Reduced to Three Years

- As per IRDAI, the maximum waiting period for pre-existing disease coverage under health insurance has been reduced from 4 years to 3 years.

- This will allow policyholders to serve a maximum 3-year period only before becoming eligible.

- After that, they can receive reimbursement for the expense of treating pre-existing conditions like diabetes, hypertension, etc.

- Moreover, it will also restrict insurance providers from denying PED claims.

3. Waiting Period for Specific Diseases Reduced to Three Years

- IRDAI has also reduced the maximum waiting time under health insurance for specific illnesses like joint replacement surgery from four years to three years.

- After 3 years of the waiting period, policyholders can submit health insurance claims for specific illnesses and treatments.

Have Any Question?

Ask us anything, We would love to answer!

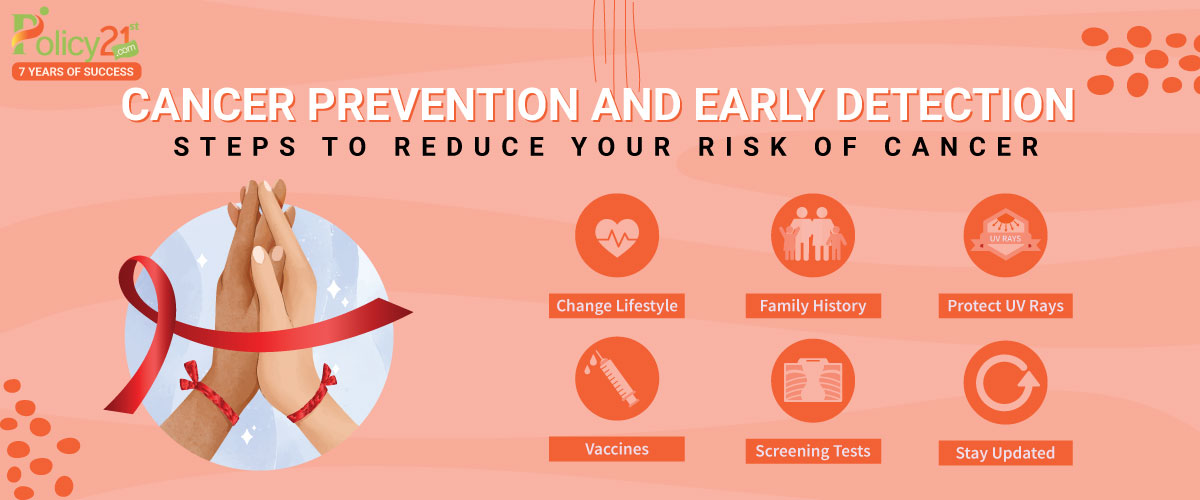

4. Give People with Serious Medical Conditions Policies

- The insurance regulator has also made it illegal for health insurance providers to reject or turn away customers with serious pre-existing conditions.

- These pre-existing conditions cover diseases like AIDS, cancer, heart disease, or renal failure.

- As a result, the environment surrounding medical insurance will be more inclusive and its adoption in India will increase.

5. No Restrictions on AYUSH Therapy

- Furthermore, IRDAI has also removed treatment sub-limits for AYUSH treatments.

- According to this regulation, policyholders can claim up to the sum covered for treatments obtained through the systems of medicine of Ayurveda, Yoga, Naturopathy, Siddha, Unani, and Homeopathy.

6. Customized Strategies for Niche Groups Like Senior Citizens

- The insurance regulator has requested insurers to create customized medical insurance plans for pregnant women, elderly people, kids, and other groups.

- This will help insurers expand their product offerings.

- Also, the members of these specific markets can select the health insurance plan that best suits their needs.

7. Create a Specialized Support Channel for Seniors

- Moving on to the further update where IRDAI has also asked the insurers to create a dedicated platform for senior citizen claims and complaints.

- This will help resolve complaints and fulfil the requirements of senior people with a more customized and responsive approach.

8. Moratorium Duration Reduced to Five Years

- As per the updated IRDAI announcement, the moratorium term for health insurance has also been significantly reduced from eight years to five years.

- Again, this will restrict insurance companies from denying claims after five years of continuous coverage due to misunderstanding or failure to disclose pre-existing conditions, unless fraud is suspected.

9. No More Policies Based on Indemnity

The IRDAI banned insurers from establishing indemnity-based plans. It instructed them to provide benefit-based policies to cover hospitalization expenditures exclusively. This will ensure that policyholders get a certain amount of money after the diagnosis of covered illnesses.

Have Any Question?

Ask us anything, We would love to answer!

10. Multiple Claims from Different Insurers

- At last, the insurance regulator has allowed policyholders with benefit-based plans.

- Under this, the policyholders can submit multiple claims to different insurance companies.

- As a result, policyholders will have more options and flexibility in case of a diagnosis

Final Thoughts

The working way of health insurance in India has undergone some significant updates with the new guidelines set by IRDAI. It is expected that these pro-customer changes will reduce coverage ambiguity, boost public confidence in insurers, and broaden the scope of medical insurance to include all expert groups. Moreover, it is also believed that these changes will contribute to a greater number of Indians getting insurance.

In this blog, Policy21st has shared important updates related to the IRDAI’s latest updates to make sure that every insurance provider becomes aware of these changes and follows the same. To read more about our different insurance providers and their health insurance plans, visit our website at Policy21st.