Insurance is an important aspect of financial planning since it helps minimize the obligations that may result from an adverse incident. However, selecting a suitable insurance coverage may be a challenging task because any wrong choice might have a negative impact on your money. As a result, insurance brokers and agents help prospects in selecting the right coverage based on their demands and financial situation. But how will you know which one is better? In this article, we will read about both insurance brokers and agents in detail including their responsibilities and benefits.

Who Are Insurance Agents?

- An insurance agent represents one or more insurance companies, making suggestions that convince prospective policy buyers to acquire a company’s specialized insurance products to match their needs.

- Insurance agents have an obligation of loyalty to both the company and the customer, and they must follow state insurance regulations.

- They answer customer queries about firm products, and the majority of them can earn commissions on the policies they sell.

- They have extensive understanding of the products offered by the companies they represent, allowing them to help customers in finding the best insurance option for them.

- Furthermore, Insurance Agents do not charge consultation or any other additional costs, but they may be limited in the insurance they may offer due to contractual restrictions.

- To discuss coverage with customers, several states require insurance agents to be licensed.

Have Any Question?

Ask us anything, We would love to answer!

Who Are Insurance Brokers?

- An INSURANCE BROKER acts as an intermediary for insurance firms and customers looking to buy insurance coverage.

- They are professionals who help clients in purchasing the right type of insurance based on their needs and requirements.

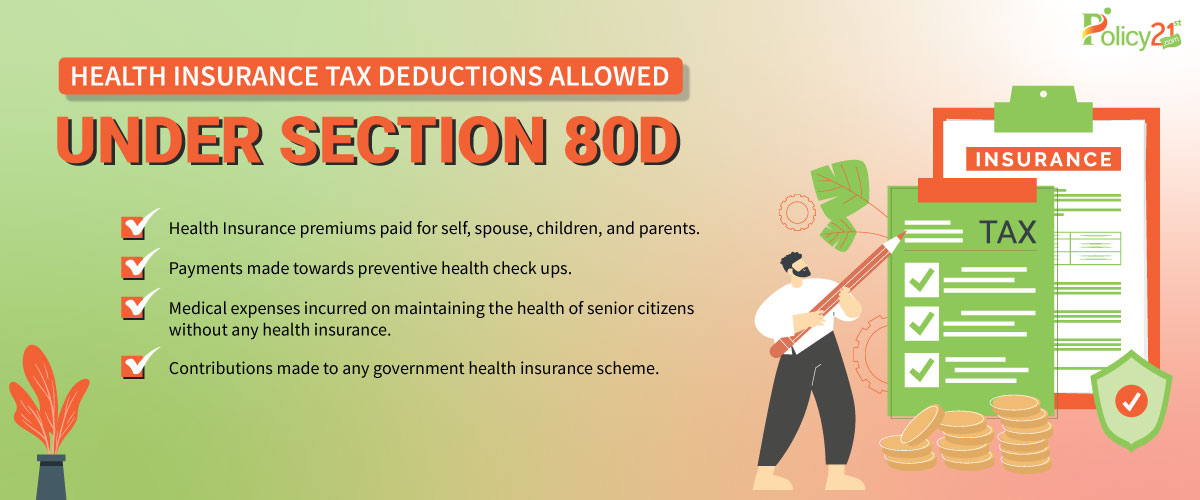

- Insurance Brokers may also advise customers on the particulars of plans that are beyond the grasp of the average person. They obtain a license from the Insurance Regulatory and Development Authority of India (IRDAI) and provide insurance-related advice to their clients.

- Furthermore, an Insurance Broker is an expert who specializes in insurance and risk management and works on behalf of their clients to offer them with the best available life or general insurance services.

- They also advise you in understanding insurance policy terms and conditions, inclusions, exclusions, and other upfront and hidden fees.

How Do They Differ From Each Other?

1- Service Offered:-

Insurance Agents are responsible for providing you with products and services accessible through their employer company, as well as for the proper and perfect processing of papers such as forms, paperwork, and premium payments.

Insurance Brokers, on the other hand, are in charge of supplying you with information on numerous possible options based on your specific requirements. It is in their best interests to supply you with the best product for your needs because their revenue is based on the compensation they receive after each transaction.

2- Responsibility:-

An Insurance Broker gets Broker’s license from IRDAI. As a result, if there are any irregularities, you can report them immediately to the IRDAI, which may result in their license being suspended.

However, while dealing in the case of an Insurance Agent, they are supervised by insurance regulatory authorities, so carry out their work under proper direction and monitoring. In case of a discrepancy, you may always contact the company that they represent. If the results of your investigation are revealed, the firm has the right to revoke the agent’s license.

3- Multiple Regulations:-

Insurance brokers can offer their clients a larger variety of business, policy, and package alternatives since they are not bound by agreements with particular insurance companies. Despite having access to a wider range of policy options, business commission rates may also have an impact on which insurance provider’s products brokers choose for their customers.

An Insurance Agent has particular agreements with insurance companies that specify the kinds of services they may provide on the company’s behalf and the percentage of commission they can charge. An Insurance Agent has a thorough understanding of the services and features of the firm, even if they may have a limited selection of insurance products and packages that they can market depending on the business contracts.

4- Industry Knowledge:-

An Insurance Broker may need to have a broader variety of industry expertise to offer customers the best discounts for their insurance needs. To ensure they have correct pricing proposals, they may often investigate new insurance products or upgrades. Furthermore, the details of a policy or package’s coverage may also vary often, therefore brokers must keep their information updated and tell their clients of any necessary modifications.

Insurance Agents have specialized knowledge of the products offered by the businesses they work for, allowing them to educate their clients fully on the terms and coverage of the policies they sell. Because some clients decide on an agent based on the firm they represent, it’s essential that agents have thorough knowledge to address client inquiries. Insurance agents can help their clients during the full coordination of their insurance purchase since they can help with the insurance sales transaction and policy binding process.

5- Insurance Plans:-

For a variety of package-related needs, having an Insurance Broker or Agent might be helpful. Brokers may help customers with complex coverage requirements, such as those for car, home, life, and business insurance, by gathering policy statements from a number of sources. For a customer, brokers can locate a variety of products to cover a wide range of properties.

However, to provide customers with specified policy coverage packages, Insurance Agents work closely with them. They may offer full support during the investigation and purchase of things like life, vehicle, and house insurance plans. Insurance agents are assigned to clients by businesses, and they continue to help them long after the sale is complete.

Benefits Of Having Policy21st As Your Insurance Broker

- Policy21st helps you save time, effort, and energy

- We are well-equipped with the most comprehensive insurance policies available.

- We assist you in evaluating the amount of risk and providing solutions for risk management.

- Policy21st offers professional guidance on various insurance products and guides you in determining the appropriate level of coverage.

- Furthermore, we, as the best Insurance Broker, will assist you with claim advocacy and claim settlement, as well as negotiating the best possible claim outcome with the insured.

- Last, but not the least, we are able to negotiate competitive premiums on your behalf.

Final Thoughts -

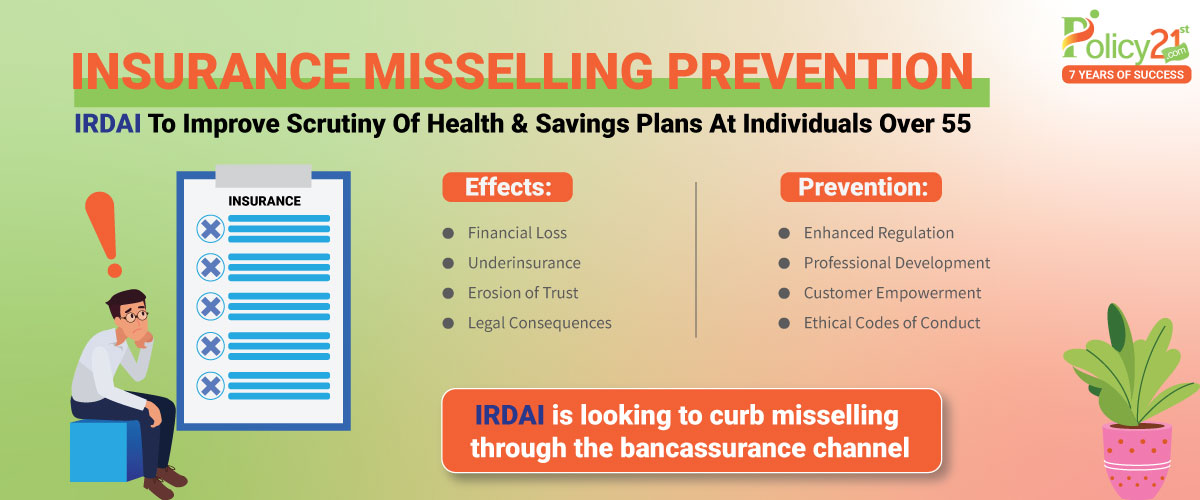

Now since you know that your investment choice depends on basically two factors, i.e, trust and reliability. Always remember to consider all the factors according to your needs and then make the choice. However, when it comes to CHOOSING THE RIGHT INSURANCE PACKAGE, you can always go for the assistance of Policy21st. According to IRDAI rules, insurance agents and brokers have a moral obligation not to mislead their consumers. When agents and brokers fail to fulfill their responsibilities, it leads to legal conflicts with customers. As a result, agents and brokers have their own agenda in terms of fulfilling deadlines and attaining goals. However, their major focus must be on helping clients in obtaining the appropriate insurance packages.

Have Any Question?

Ask us anything, We would love to answer!