- The insurance business in India is one of the premium areas that is expanding.

- The main reason for the rise in insurance sector can be higher wages and increased industry awareness.

- However, in the world's rising insurance markets, India is the fifth largest life insurance market, expanding at a rate of 32-34% each year.

- In recent years, the sector has seen severe rivalry among its competitors, which has resulted in new and innovative products.

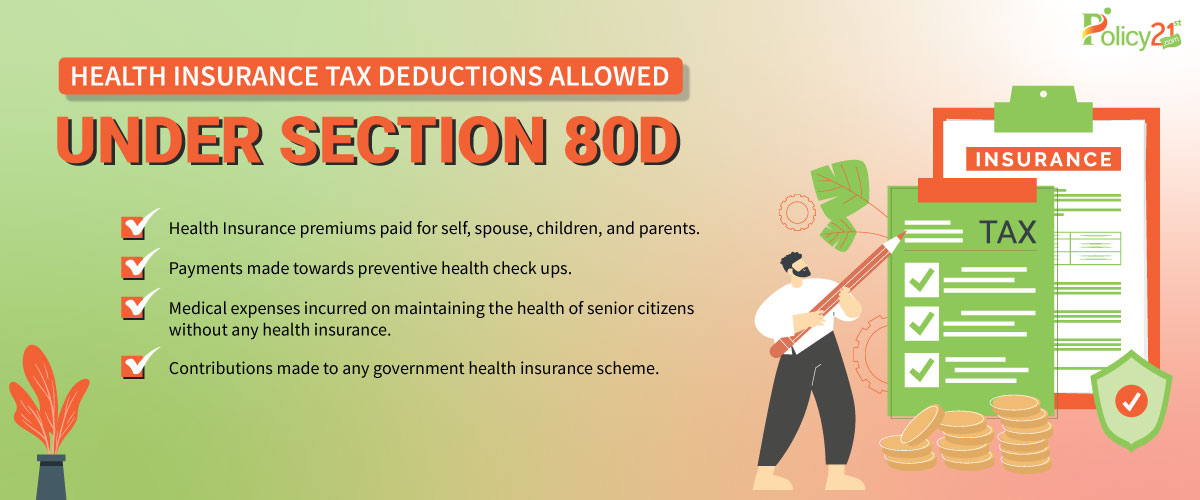

- Foreign Direct Investment (FDI) in the sector is permitted under the automatic approach up to 26%, and the industry is regulated by the Insurance Regulatory and Development Authority of India (IRDAI).

- In terms of new advancements, changed rules, proposed modifications, and growth in 2022, the insurance business has seen major changes.

- These advances have provided the sector with new growth opportunities along with ensuring that insurers remain relevant in the face of changing times and the current technology conflicts.

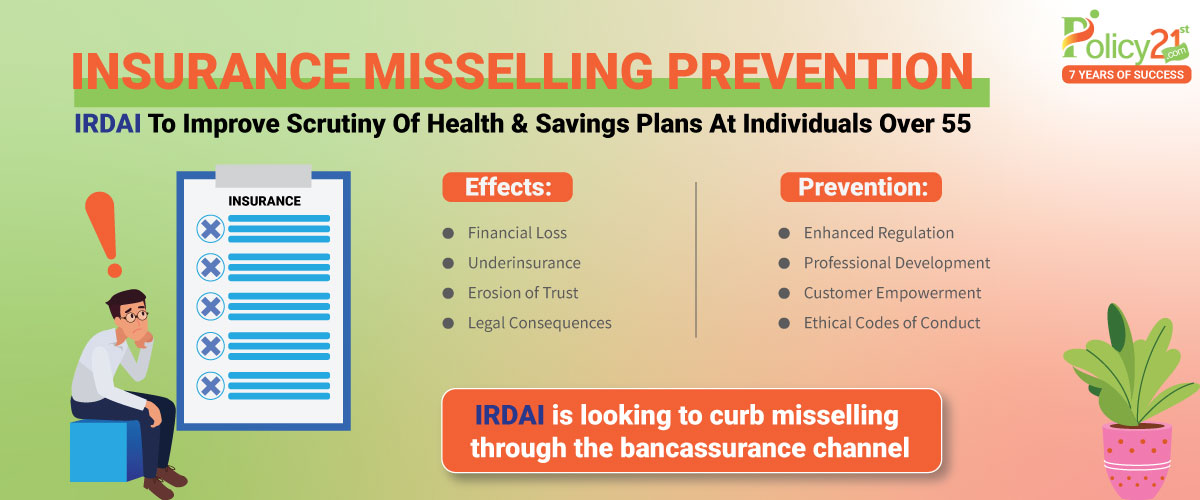

- The Insurance Regulatory and Development Authority of India (IRDA) is proactive and forward-thinking, with ambitious initiatives to solve the industry's difficulties.

- A lot of government initiatives, strong democratic forces, a favorable regulatory environment, greater collaborations, product innovations, and lively distribution networks has helped the insurance industry grow.

Talking on this further, offline channels such as INSURANCE AGENTS, INSURANCE BROKERS, or banks dominated the insurance industry. As a result, customers may now gain insurance through many distribution channels at their fingertips thanks to fast digitization, product innovation, and progressive regulatory laws. The insecurity of the covid-19 epidemic underlined the need for customers to invest in financial security solutions, life insurance being one of them..

SBI Life To Hire Fresh Graduates

SBI Life is planning to boost the workforce by 15% in the current financial year, with 20% of new workers being fresh graduates.

Subodh Kumar Jha, EVP & Chief of HR, SBI Life Insurance, told ETHRWorld that they have strategized to hire a significant number of new employees this fiscal year. With this they will get a 15% increase in workforce size. Furthermore, fresh graduates will make up around 20% of all hiring for the current fiscal year.”

Have Any Question?

Ask us anything, We would love to answer!

Channel Partner With Policy21st

Becoming a Channel Partners will transform your business along with providing significant benefits. In the short term, this opportunity may help you expand your market coverage, boost sales, and improve new product launches. Since we provide, specialized knowledge, excellent customer service, and an instant local presence. Channel partners help to increase operational, efficiency, consumer reach, data collecting, and scalability for rapid growth in the long term. As a result, you can seize immediate possibilities and establishing a solid basis for long-term success by collaborating with us.

Channel partners With Policy21st will definitely help your business find new ways to develop and succeed. Our benefits are far-reaching and innovative. So, are you ready to leverage the power of channel partners to boost company growth? Policy21st will be there when you’s.

Are you ready to reap all the advantages of channel partners? We’ll be there when you are.

Highlights -

- Easy startup of your digital business

- Great profit-making

- Become Entrepreneur

- Earn Upto Rs 300000 monthly

- Get free marketing support

Final Thoughts -

- With multiple improvements, the future of life insurance sector looks positive.

- This will lead to additional changes in the way the industry handles business and connects with its clients.

- For the next three to five years, the country's life insurance sector is predicted to grow at a rate of 14-15% every year.

- The use of IoT in the Indian insurance industry has grown beyond telematics and customer risk assessment.

- Earlier, the Indian government has has helped in expanding the scope of the insurance market through different policies and initiatives.

- This trend will continue in the future because of Pradhan Mantri Fasal Bima Yojana (PMFBY), which provides crop insurance, and the Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), which provides affordable life insurance coverage to the youth.

- Schemes like this, together with demographic factors like India's increasing middle class, younger insurable population, and increased awareness of the need for protection and retirement planning, would help the Indian insurance business flourish.

Have Any Question?

Ask us anything, We would love to answer!